Ampol Enters Agreement To Acquire EG Australia

Ampol Enters Agreement To Acquire EG Australia

Wednesday 14 August

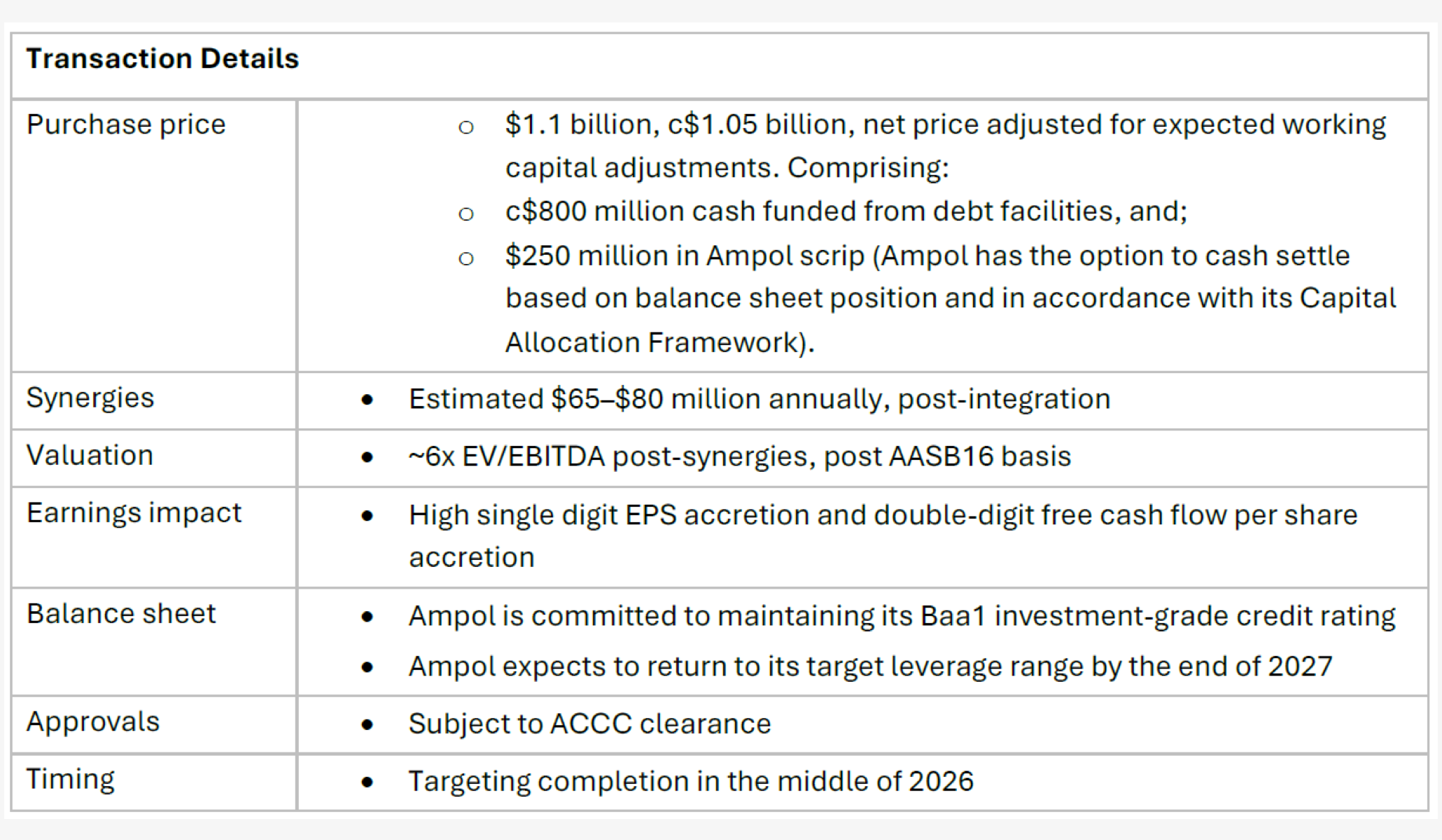

Ampol Limited (ASX: ALD) today announced it has entered into an agreement to acquire EG Australia, a leading Australian fuel and convenience retailer with approximately 500 sites nationwide, for a headline price of $1.1 billion.

The acquisition strengthens Ampol’s position as one of Australia’s leading transport energy providers, expanding our fuel and convenience offers for customers and delivering earnings and free cash flow per share accretion for shareholders.

It marks a pivotal and highly strategic step forward for Ampol, where a larger, combined network will allow Ampol to better serve a broader customer base. Through the expansion of the Ampol Foodary convenience retailing network and the rollout of the value-oriented U-GO offering, Ampol is uniquely placed to leverage its capability as a known and trusted brand in fuel and convenience retailing.

Managing Director and CEO, Matt Halliday said the acquisition is a strategic growth opportunity for Ampol given the longstanding relationship with EG Australia, which includes a brand licence agreement and existing 15-year fuel supply agreement.

"The proposed EG Australia acquisition makes sense for Ampol. It is a business and market we understand well through more than 5 years of commercial relationship. We are uniquely placed to leverage our demonstrated capability as a known and trusted brand in fuel and convenience retailing to integrate the business smoothly and realise the value offered through this investment," Halliday said.

"For customers, the combined network will offer greater choice and convenience, enabling us to better serve a broader customer base. Key to this will be the expansion of our premium Ampol Foodary convenience retail network, the rollout of our value-oriented U-GO offering, and extension of Woolworths Everyday Rewards.

"For shareholders, the transaction is accretive to earnings per share and free cash flow, underpinned by $65–$80 million in identified synergies from overhead rationalisation, U-GO conversion cost savings and efficient operations and economies of scale – all achievable through proven integration levers.

"It will also provide a greater footprint and flexibility to execute our strategy around electric vehicle charging, to align with the pace of customer adoption, which we see as a vital component to our long-term plans."

The deal will be funded by a mix of debt facilities, upfront working capital release, the proceeds from divestments and Ampol shares issued to the vendor. The alignment of the two businesses will generate significant synergies with a 6 times EBITDA multiple post synergies on a post AASB 16 basis.

After this deal is completed, the fuel and convenience and fuel marketing businesses, across Australia and New Zealand, will represent circa 85% of Ampol Group earnings.

Ampol will propose to divest approximately 20 sites across locations where network overlap will occur as part of its application to the ACCC.

This acquisition remains subject to regulatory approval and is anticipated for completion in mid-2026.

– ENDS –

For further information, please contact: media@ampol.com.au